This ratio is a snapshot of your company’s overall financial well-being. Conveniently, you get the number of years it will take to repay all your debt. Understanding the Cash Coverage Ratio is crucial because it helps stakeholders assess whether a company generates enough cash from its operations to meet its interest obligations.

Cash Equivalents

The higher value of the cash coverage ratio, the more cash available for the interest expenses. In either case, the cash equivalents will include any short-term investments that can be converted into cash within three months or less. Ultimately, both metrics give investors valuable information about a company’s liquidity and solvency which can help them evaluate their potential risk when investing in any given business. ABC Co. reported Earnings Before Income and Taxes (EBIT) of $40 million in its income statement.

- It is typically calculated by dividing a company’s total current assets by its current liabilities.

- Analysts and investors may study any changes in a company’s coverage ratio over time to assess the company’s financial position.

- Whether the firm is worthy of loans and at what interest rate loan should be provided.

- These ratios (including profitability ratios, liquidity ratios, solvency ratios, and activity ratios) act as a metric to assess the entity’s financial performance.

- There is no requirement for a company to be profitable to pay interest on debt finance.

Current Cash Debt Coverage Ratio: Definition

Several other coverage ratios are also used by analysts, although they are not as common. As a rule of thumb, utilities should have an asset coverage ratio of at least 1.5, and industrial companies should have an asset coverage ratio of at least two. Current are federal taxes progressive liabilities are always shown separately from long-term liabilities on the face of the balance sheet. A Cash Coverage Ratio above 1 is generally considered healthy, indicating that a company has sufficient earnings to cover its interest expenses.

Examples of Coverage Ratios

EBITDA is used in the Cash Coverage Ratio because it represents the cash-generating ability of a company’s core operations. Unlike net income, which can be influenced by non-operational factors like interest and taxes, EBITDA strips out these effects, providing a cleaner view of a company’s operational cash flow. The credit analysts see the company is able to generate twice as much cash flow than what is needed to cover its existing obligations. Depending on its lending guidelines, this may or may not meet the bank’s loan requirements.

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Instead of considering just one aspect of a year, it accounts for the entity’s past and future performance in terms of making debt payments. Assets America was incredibly helpful and professional in assisting us in purchasing our property. It was great to have such knowledgeable and super-experienced, licensed pros in our corner, pros upon which we could fully rely.

A higher ratio indicates that a company has enough cash resources to satisfy interest expenses. Higher coverage ratios indicate a better ability to repay financial obligations. The formula to calculate the cash flow coverage ratio (CFCR) is as follows. Lenders will analyze financial statements to evaluate the health of the company when companies pursue loans. This signifies that they now have enough money to pay off all debt obligations, which is good for potential lenders. If the ratio is greater than one, the company has sufficient finances to pay off its present obligations.

If a company is operating with a high coverage ratio, it may decide to distribute some of the extra cash to shareholders in a dividend payment. Suppose XYZ & Co. is seeking out a loan to build a new manufacturing plant. The lender needs to review the company’s financial statements to determine XYZ & Co.’s credit worthiness and ability to repay the loan. Properly evaluating this risk will help the bank determine appropriate loan terms for the project.

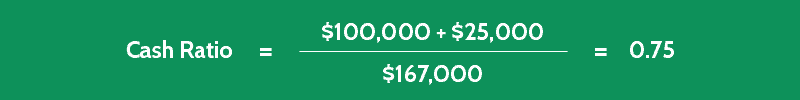

The cash ratio or cash coverage ratio is a liquidity ratio that measures a firm’s ability to pay off its current liabilities with only cash and cash equivalents. The cash ratio is much more restrictive than the current ratio or quick ratio because no other current assets can be used to pay off current debt–only cash. A cash coverage ratio measures the ability of a company to use its existing cash reserves to cover its short-term debts. It is typically calculated by dividing a company’s total current assets by its current liabilities. The cash flow coverage ratio is calculated by dividing the operating cash flow (OCF) of a company by the total debt balance in the corresponding period.

The Interest Coverage Ratio is especially useful for evaluating the overall debt burden, including non-cash interest obligations. It is frequently used by long-term creditors and bondholders to assess whether a company generates enough earnings to cover its total interest costs over time. Investors also want to know how much cash a company has left after paying debts. After all, common shareholders are last in line in liquidation, so they tend to get antsy when most of the company’s cash is going to pay debtors instead of raising the value of the company. When the cash coverage ratio value is more than 1 means the company has the cash available more than the interest expenses. Conversely, when the cash coverage ratio number is less than 1 means the company’s total cash can not cover its interest expenses.

Creditors are uncomfortable with a cash debt coverage ratio well below 1.0. Because a low figure indicates trouble meeting your debt obligations. Obviously, this indicates that you have enough cash and equivalents available to pay current bills. The CCR measures cash and equivalents as a percentage of current liabilities. However, the CDCR measures net cash from operations as a percentage of average current liabilities. Finally, the cash flow to debt ratio measures net cash from operations as a percentage of total debt.

He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Companies can improve the Cash Coverage Ratio by increasing EBITDA, reducing debt, or refinancing loans at lower interest rates. In this guide, we will delve into the Cash Coverage Ratio, how to calculate it, what it reveals about a company, and why it is indispensable for both investors and corporate managers. Companies with high ratios tend to attract more investors, showing that management is taking proactive steps toward managing their funds responsibly. Because an increase in net working capital (NWC) is an outflow of cash, the $5 million increase is a negative adjustment to net income.