She has worked in multiple cities covering breaking news, politics, education, and more. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Difference Between Interest Expense and Interest Payable

F. Giant must pay the entire principal and, in the first case, the accrued interest. As these partial balance sheets show, the total liability related to notes and interest is $5,150 in both cases. It would be inappropriate to record this transaction by debiting the Equipment account and crediting Notes Payable for $18,735 (i.e., the total amount of the cash out-flows). Because interest is calculated based on the outstanding loanbalance, the amount of interest paid in the first payment is muchmore than the amount of interest in the final payment.

- Selling bonds at a premium or a discount allows the purchasers of the bonds to earn the market rate of interest on their investment.

- It’s important to calculate this rate before taking out a loan of any sort to make sure the business can afford to repay its debt.

- For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- Interest payable is typically combined with other current liabilities on the balance sheet, but it may also be presented as a separate line item.

- Recall from the discussion in Explain the Pricing of Long-Term Liabilities that one waybusinesses can generate long-term financing is by borrowing fromlenders.

- Payable interest is an obligation regardless of whether the debt is short-term or long-term.

By accessing and using this page you agree to the Terms and Conditions.

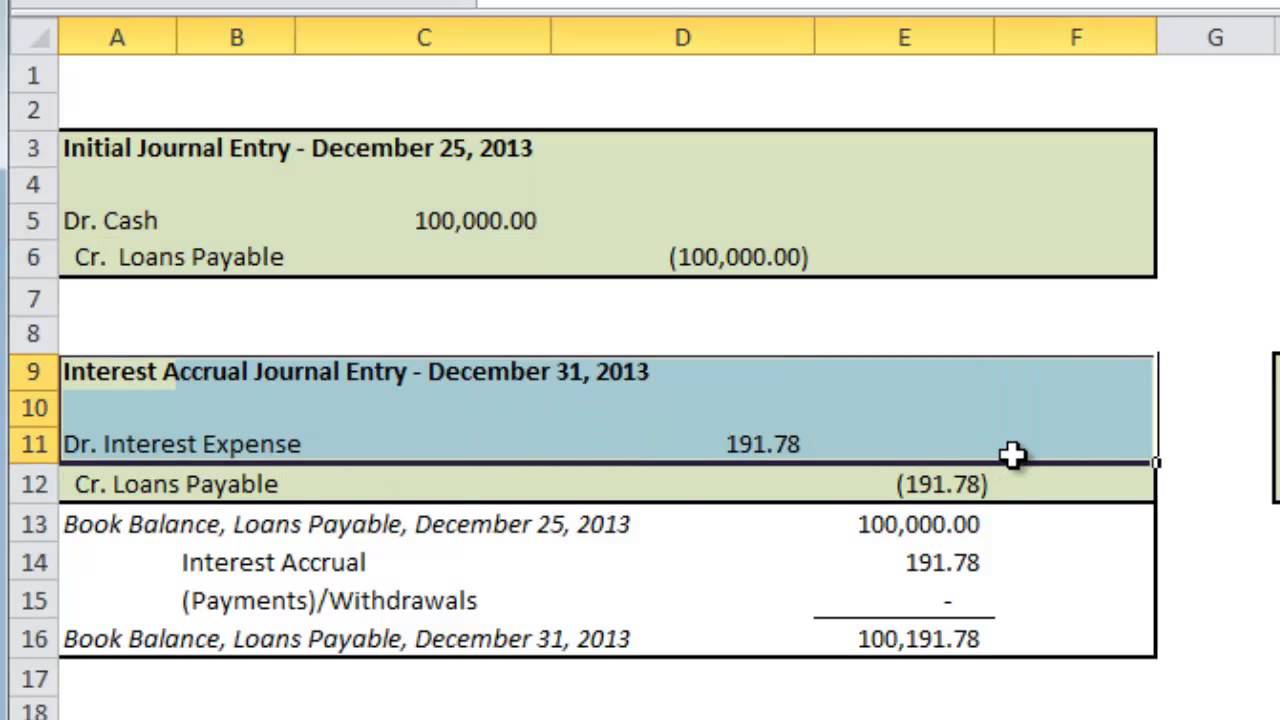

In this case, the company creates an adjusting entry by debiting interest expense and crediting interest payable. The size of the entry equals the accrued interest from the date of the loan until Dec. 31. This journal entry will eliminate the $3,000 of interest payable that the company has recorded on Dec 31, 2020. The entry is for $150 because the amortization entry is for a 3-month period.

Do you own a business?

The $13,420 of Wages Expense is the total of the wages used by the company through December 31. The Wages Payable amount will be carried forward to the next accounting year. The Wages Expense amount will be zeroed out so that the next accounting year begins with a $0 balance. The balance in the liability account Accounts Payable at the end of the year will carry forward to the next accounting year. The balance in Repairs & Maintenance Expense at the end of the accounting year will be closed and the next accounting year will begin with $0.

Notes Payable Issued to Bank

For these types of debts, the interest rate is usually fixed at an average of 8-13%. Your journal entry should increase your Interest Expense account through a debit of $27.40 and increase your Accrued Interest Payable account through a credit of $27.40. To record the accrued interest over an accounting period, debit your Accrued Interest Receivable account and credit your Interest Revenue account. Let’s say you are responsible for paying the $27.40 accrued interest from the previous example. Your journal entry would increase your Interest Expense account through a $27.40 debit and increase your Accrued Interest Payable account through a $27.40 credit.

Ask Any Financial Question

The firm would report the $2,000 Bond Interest Payable as a current liability on the December 31 balance sheet for each year. The explanation is that every day that the organization owes cash to some party, it causes premium cost and a commitment to pay the premium of using that cash. In order to understand the accounting for interest payable, we first need to understand what Interest Expense is. Interest expense is the cost of using monitory facilities or consuming financial benefits for some time that offer by a financial institution or similar institution. This account is a non-operating or “other” expense for the cost of borrowed money or other credit. When the company borrows money from a bank or other creditors, it will record it as debt on the financial statement.

Now, when you pay your interest, the interest expense account doesn’t change. So, the recording of the interest expense will be on October 31st, for just one month of the year. In this guide, we will go through the different types of interest expenses, and the appropriate steps for calculating and recording them. After all, unless the owner is managing the business just for fun, they want to expand operations in the hopes of earning more money. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

For example, if an investor receives $1,000 of interestand is in the 25% tax bracket, the investor will have to pay $250of taxes on the interest, leaving the investor with an after-taxpayment of $750. So the same investor receiving $1,000 of interestfrom a municipal bond would pay no income how to calculate gross income per month tax on the interestincome. This tax-exempt status of municipal bonds allows the entityto attract investors and fund projects more easily. Because of the time lag caused by underwriting, it is notunusual for the market rate of the bond to be different from thestated interest rate.

Thus, once the firms are aware of the rate of interest at which the loans are available, they can calculate the value, converting the interest rate into a decimal form. When it comes to calculating the interest payment figures, there is no specific interest payable formula. For this calculation, the normal mathematical equation to calculate the interests is used. However, there is a series of steps that must be followed to ensure the calculation is done accurately. Accounting is a precise science and needs to be done correctly to ensure books balance and accounting principles are met for legal purposes. If you don’t have extensive accounting experience, particularly when it comes to debt obligations, seek out professional help to ensure your numbers are correct.