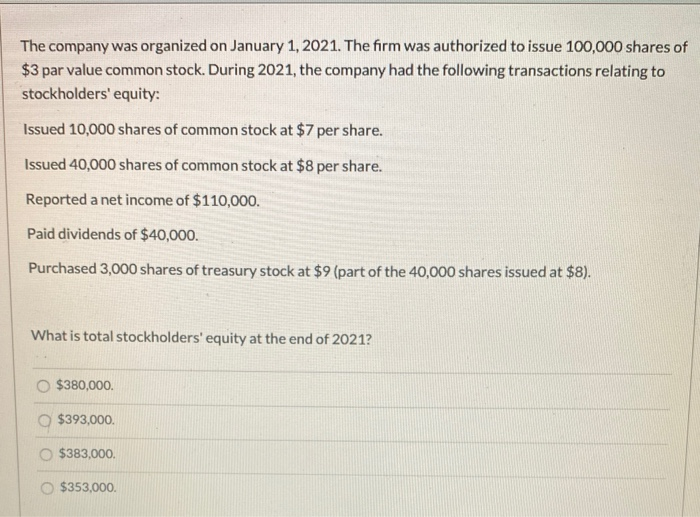

That seems the logical first step in analyzing the information provided by a company about its capital shares. Even though the company is purchasing stock, there is no assetrecognized for the purchase. Immediately after the purchase, the equitysection of the balance sheet (Figure14.6) will show the total cost of the treasury shares as adeduction from total stockholders’ equity.

Journal entries for the issuance of common shares

Company P issue 10,000 shares of its $ 1 par value common stock in exchange for the building. The building has a book value of $ 1.3 million but the owner claims that the fair value of the building is $ 1.5 million which base on the internal evaluation team. Company P share is trading at $ 100 per share in the capital market. For example, Company ABC issues 100,000 shares to the capital market with a par value of $1 per share. As the company is making a good profit, the investors really interest in purchase the share. The common stock also comes with the right to receive a part of the underlying company’s assets if it liquidates.

Types of Common Stock Transactions

- It is printed on the face of an old fashioned stock certificate and indicates (again depending on state law) the minimum amount of money that owners must legally leave in the business.

- But please scroll down to the example that matches the problem you are dealing with; we should have them all covered.

- However, some companies may also issue shares in exchange for other instruments, for example, convertibles or warrants.

- In this example, ABC Ltd is acquiring an allotment of equipment from XYZ Ltd that is closing down.

- The general rule isto recognize the assets received in exchange for stock at theasset’s fair market value.

However, the legal capital of the DeWitt Corporation is $200,000. DeWitt carries the $ 30,000 received over and above the stated value of $200,000 permanently as paid-in capital because it is a part of the capital originally contributed by the stockholders. However, the legal capital of the DeWitt Corporation is $200,000. Now we are into the exciting part of the article, the journal entries.

Reporting Treasury Stock for Nestlé Holdings Group

The 800 repurchased shares are no longer outstanding,reducing the total outstanding to 9,200 shares. A few months later, Chad and Rick need additional capital todevelop a website to add an online presence and decide to issue all1,000 of the company’s authorized preferred shares. The Cash accountincreases with a debit for $45 times 1,000 shares, or $45,000. ThePreferred Stock account increases for the par value of thepreferred stock, $8 times 1,000 shares, or $8,000. The debit to the share capital account removes the 100,000 class A shares from ABC’s equity. The $1,400,000 debit to the additional paid-in capital account also reduces ABC’s equity section.

In most cases, the share premium account involves recording excess funds received from new share issues. In exchange for these instruments, the company issues shares, which provide the holder with several rights. The latter source of finance comes from third parties, such as banks and other financial institutions.

In essence, however, the accounting treatment for the issuance of common stock will remain the same. Common stock is a financial instrument that represents the ownership of a company. In accounting, this term describes the total finance received from a company’s shareholders over the years. Companies may also refer to it as ordinary stock, which represents the same concept. In most circumstances, common stock is the only type of equity instrument that companies may issue. Kellogg reports that one billion shares of common stock were authorized by the state of Delaware but only about 419 million have actually been issued to stockholders as of the balance sheet date.

As mentioned, nowadays, par value has nothing to do with the market value of the common stock and it is just a number on the paper. Likewise, investors typically do not deem that the par value of the common stock is necessary to exist before they purchase the stock for their investments. Understanding these entries helps clarify how each type of transaction affects a company’s financial statements and equity structure. The additional paid-in capital is a part of total paid up capital that increases the stockholders’ equity. Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer.

And the real value of how much a company’s shares are actually worth and sold for is the market value, not the par value. The par value of the common stock nowadays is usually just the number on the paper. The market price per share, on the other hand, refers to the per share value or worth at which a company’s stock is actually traded in the secondary market. Stock split is the process of dividing the current share number into multiple new shares to boost the stock liquidity. The company simply increase the number of outstanding share by a specific time and keep the total dollar value of share the same.

Therefore you will find common stock disclosed in the balance sheet (often referred to as the statement of financial position). Kellogg records the issuance of whats the difference between a sales order and an invoice a share of $0.25 par value common stock for $46 in cash as follows3. Of course, the par value of the common stock has nothing to do with its market value.

How many shares outstanding does Pickle show on its balance sheet at the end of the year. Chad and Rick have successfully incorporated La Cantina and areready to issue common stock to themselves and the newly recruitedinvestors. Thecorporate charter of the corporation indicates that the par valueof its common stock is $1.50 per share. When stock is sold toinvestors, it is very rarely sold at par value.

Stock with no par value that has beenassigned a stated value is treated very similarly to stock with apar value. Keep in mind your journal entry must always balance (total debits must equal total credits). Watch this video to demonstrate par and no-par value transactions. Notice how the accounting is the same for common and preferred stock. For small stock dividends, retained earnings are debited at the market value of the shares being issued, with credits to both the common stock and APIC accounts. When companies engage in stock-related transactions, such as issuing stock, declaring stock dividends, or executing stock splits, different accounts are affected in specific ways.