For example, a startup tech company with a lot of potential may have a lower EPS than an established healthcare company. But investors may be willing to pay a higher P/E ratio for a smaller, faster-growing company than a slow-growing or stagnant company. Over time a stock price fluctuates with expected future changes in EPS. If a company can quickly Trend exhaustion indicator grow its EPS, then its stock will likely rise.

The earnings of an individual are money that person receives for work or business ownership. But exactly how earnings are calculated can be a somewhat complicated matter in the world of business. Here’s what you need to know about earnings and how they impact a business.

Would you prefer to work with a financial professional remotely or in-person?

They are a key element in determining the value of a company’s stock. If earnings are lower than expected, a company’s stock price may go down. Earnings are different, however, than gross income, which is income before taxes and other expenses are deducted. The earnings per share number may also be inflated with share buybacks or other methods of changing the number of shares outstanding.

Company Earnings and EPS: Everything Investors Need to Know

The big moves in individual stock prices can, in turn, lead to turbulence in the broader stock market. A broader audience, like the average investor, may also find earnings reports to be helpful. That’s because this information can be useful for comparing companies that operate in related industries. And the commentary from management (either within the report or on conference calls to discuss the results) adds some color to what’s happening within the company, along with broader trends like price increases. In addition, monitoring earnings reports for members of the S&P 500 can provide valuable insight about the health of the U.S. economy.

Corporate tax rates and rules play a major role in determining the post-tax profitability of companies. Changes in direct and indirect tax structures by the government in annual budgets are able to positively or negatively impact corporate earnings. Earnings and profitability are directly affected by input costs such gbp to cad historical exchange rates as raw materials, wages, power and fuel expenses, finance costs, etc.

Volatile and lumpy earnings signal risks like dependence on one-time gains, unstable demand, etc. Faster growth in profits than the industry reflects gaining market share. EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortisation. It is a measure of a company’s operating performance and profitability before factoring in non-core expenses. EBITDA is widely used by investors in the Indian stock market to evaluate and compare companies, especially across the same industry. The P/E ratio reveals how much investors are willing to pay for each dollar of the company’s earnings.

Investors and analysts watch a company’s EPS closely because it is an indicator of the real profitability of the company. Say the business received a big one-time payment for the sale of an investment property. (That is, the transaction is not strictly revenue from the core business.) The payment might be big enough to skew the earnings number higher than the revenue number. That’s why reviewing a company’s earnings—which deducts expenses from revenue—is key to evaluating the long-term sustainability of a company.

What Is in an Earnings Report?

To calculate EPS, take the earnings left over for shareholders and divide by the number of shares outstanding. Net profit is calculated from the final section of an income statement. It is the result of operating profit minus interest and taxes, with interest and taxes being the last two factors to influence a company’s total earnings. Net profit is used in the calculation of net profit margin, which gives the final portrayal of how much a company is earning per dollar of sales.

- The quarterly earnings reports in which they do this let shareholders and potential investors take a peek under the hood to see how a business is faring.

- It is calculated by dividing the current market price per share by the EPS.

- Net income, also known as net earnings, can be calculated by deducting the taxes from EBT.

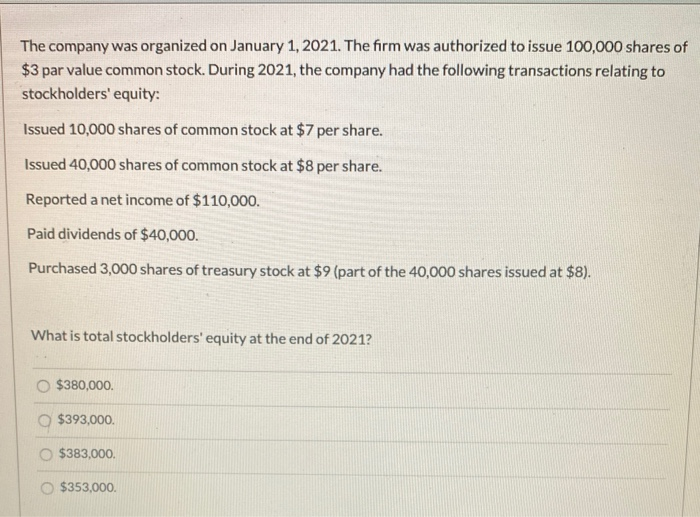

- Holders of cumulative preferred shares are entitled to be paid current and past dividends (dividends in arrears) that the common shareholders have not paid.

Let us understand how to use the earnings calculator with the help of a couple of examples.

Holders of cumulative preferred shares are entitled to be paid current and past dividends (dividends in arrears) that the common shareholders have not paid. Private companies have it easy—they aren’t required to disclose any financial information to the general public. But public companies are required to provide their shareholders, financial analysts and the broader public with a complete picture of how the business is doing each quarter. Earnings per share (EPS) refers to net profit divided by the number of shares, is used for publicly held companies who have actively traded stock. The earnings per share figure is probably the most used financial calculation.

“Sales have virtually flatlined and have done so against the backdrop of a very poor prior year,” Saunders said in a Wednesday research note. “And this has occurred during a quarter when multiple banner events — among them, back to school, Halloween, and deal weeks and days — should secrets of forex breakout trading finally revealed have helped to drive spending.” Apple Inc. (AAPL) posted a net sales number of $394,328 billion for the period, representing an increase of over $28 billion when compared to the same period a year earlier. Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals. Ask a question about your financial situation providing as much detail as possible. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.