It is a non-GAAP measure some companies use to create the appearance of higher profitability. Keep in mind that when you calculate the ratio, you’re using all debt, including short- and long-term debt vehicles. Again, what constitutes a reasonable debt-to-capital ratio depends on the industry. Some economists have stated that the rapid increase in consumer debt levels has been a contributing factor to corporate earnings growth over the past few decades. Others blamed the high level of consumer debt as a major cause of the Great Recession.

Times Interest Earned (Interest Coverage Ratio):

However, if the company finances the entire $1 million through equity, the return on equity would only be 20%. The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Learn first. Trade CFDs with virtual money.

- Leveraged finance allows companies to use debt to finance an investment, with most large investment banks having separate divisions dedicated to it.

- When calculating the operating leverage, EBIT is a dependent variable that is determined by the level of sales.

- Bankrate.com is an independent, advertising-supported publisher and comparison service.

- If the company uses debt financing and borrows $20 million, it now has $25 million to invest in business operations and more opportunities to increase value for shareholders.

Conversely, if the asset’s value depreciates by 40%, the asset would be worth Rs. 6,00,000, leading to a loss of Rs. 4,00,000 for the company. J.B. Maverick is an active trader, commodity futures broker, and stock market analyst 17+ years of experience, in addition to 10+ years of experience as a finance writer and book editor. Leverage ratios are not set in stone and can vary between industries and sectors. If EBIT had decreased instead to $70 million in Year 2, what would have been the impact on EPS? EPS would have declined by 33.3% (i.e., DFL of 1.11 x -30% change in EBIT).

Net debt-to-EBITDA ratio and how to calculate it

There is a suite of financial ratios referred to as leverage ratios that analyze the level of indebtedness a company experiences against various assets. The two most common financial leverage ratios are debt-to-equity (total debt/total equity) and debt-to-assets (total debt/total assets). Financial leverage, the strategy of using borrowed funds to boost investment returns, is crucial for businesses seeking to maximize profitability and facilitate growth. By employing debt to finance assets or operations, companies can access more capital than they could afford otherwise, potentially increasing returns on investments. However, it’s essential to strike a balance between risk and return, as excessive leverage can also heighten risks.

Alternatively, Company XYZ could choose a different path by financing the asset using a combination of common stock and debt in a 50/50 ratio. In this case, if the asset appreciates by 40%, its value would also become Rs. 14,00,000. It can then use the profit to pay off the debt faster and own the asset completely. A leverage ratio of 1 means the company has equal amounts of debt and the other, comparable metric being measured. It is, undoubtedly, a powerful tool to enhance capital, but it does not necessarily turn out to be good.

How to Calculate Financial Leverage?

This ratio indicates that the higher the degree of financial leverage, the more volatile earnings will be. Since interest is usually a fixed expense, leverage magnifies returns and EPS. This is good when operating income is rising, but it can be a problem when operating income is under pressure.

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective financial leverage is measured by analysis, and the opinions are our own. This is because there may not be enough sales revenue to cover the interest payments.

That opportunity comes with high risk for investors because leverage amplifies losses in downturns. For businesses, leverage creates more debt that can be hard to pay if the following years present slowdowns. The goal of DFL is to understand how sensitive a company’s EPS is based on changes to operating income. A higher ratio will indicate a higher degree of leverage, and a company with a high DFL will likely have more volatile earnings. You can analyze a company’s leverage by calculating its ratio of debt to assets.

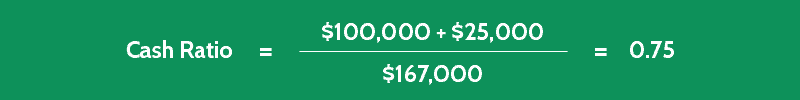

You can also compare a company’s debt to how much income it generates in a given period using its Earnings Before Income Tax, Depreciation, and Amortization (EBITDA). The debt-to-EBITDA ratio indicates how much income is available to pay down debt before these operating expenses are deducted from income. For example, start-up technology companies may struggle to secure financing and must often turn to private investors.

To find the leverage ratio, key financial ratios such as debt-to-equity, interest coverage, and debt-to-asset ratios can be calculated using a company’s balance sheet and income statement data. The debt-to-asset ratio measures the amount of debt a business has relative to its total assets. A higher debt-to-asset ratio means that a business is more heavily reliant on borrowed funds. The debt-to-capital ratio measures a company’s leverage by assessing how much debt the company has versus how much total capital it has.